Photo credit: Honor

San Francisco-based startup Honor launched in 2014 and raised their first round of venture capital in 2015 to create technology-enabled solutions in the home care industry. Now in over 800 cities and towns across the country, Honor partners with home care organizations and hires their workforce by using machine learning to recruit, train, and retain caregivers as they provide assistance with activities of daily living for older adults. The Pulse sat down with Kelly Cheng WG ‘15, the company’s Head of New Markets and Business Development, to dig into the innovative work that Honor is doing and talk about the future of the quickly evolving home care industry.

The Pulse: What was your background prior to working at Honor?

Prior to Honor, I advised executive teams on innovation and growth–primarily in the healthcare and life sciences sectors and occasionally in financial services and other sectors. Some of the provider executives I worked with were committed to innovating across the full continuum of care, and I supported them in exploring joint ventures and partnerships that took them into the home, which brought me into the post-acute world. I also spent time on new product concepts and new markets at two digital health startups–one was a later-stage cloud EMR startup where I developed product concepts to bring real world evidence and analytics to life sciences companies. The second was a seed stage company that used Google Glass to address clinician burnout–being that it was seed stage, I wore a lot of different hats from partnerships, sales, operations, to everything in between.

The Pulse: How did you originally learn about Honor and what in particular makes the company unique?

The first exposure for me was through Rock Health. They announced the addition of Honor to their portfolio in 2015 after Honor had already assembled a stellar leadership team and was backed by well-known investors, including Marc Andreessen. Additionally, the Healthcare Management program at Wharton was helpful in giving me context around the healthcare industry from which I could understand how Honor was doing something different. Honor’s mission is “We’re changing the way we care for our parents.” This also includes changing the conversation around how we can have older adults age with dignity.

Just to clarify how home care is different from home health services–Honor caregivers are in the home, focused on non-medical activities of daily living, sometimes known as private duty care or personal care. These caregivers are performing tasks and wellness activities that aren’t necessarily part of their clients’ electronic medical records. Honor uses advanced technology and data to support older adults as their conditions change. We partner with existing home care companies and support them with technology and workforce management services.

Given the caregiver shortage across the country, it is hard to hire quality caregivers. We allow home care organizations to remain independent while joining the Honor Care Network, which is a nationwide network of high-quality local home care agencies; this alleviates their concerns around caregiver shortages, balancing high quality with growth, and more. We do a lot of research to understand what caregivers are looking for in an employer–after joining Honor, home care organizations see a 40% decrease, on average, in how likely a caregiver is to turn over in the first year.

One of our goals is to professionalize a career that was viewed 15 years ago as an afterthought in the healthcare industry. Back then, value-based care and social determinants were less prevalent as focus areas across healthcare, and now they are often the first conversation; that is incredible to see. The non-medical home care workforce has a different workflow than a clinician that is going in to visit the home for a short episode. Personally, it was exciting for me to see that Honor wasn’t focused on pushing a lot of tech onto senior adults–it was much more focused on the caregiver employee experience, the back-end logistics, and the features that work best for operations teams. It’s less about adoption of technology among older adults and more about providing higher quality care.

The Pulse: What is your current role at Honor?

I’ve supported our growth strategy via three major avenues–geographic expansion strategy, ecosystem partnerships, and service line strategy. Similar to telehealth, home care is regulated in a completely different way in each state. From a workforce management perspective, regulations can vary dramatically between cities and counties. There are also a huge range of global brands and industries that care about the older adult population, ranging from consumer, retail, technology, healthcare, life sciences, and of course, senior living.

The Pulse: Honor is using AI/machine learning in a historically traditional industry. What have been the different perceptions among various stakeholders in the industry about the value of advanced technology?

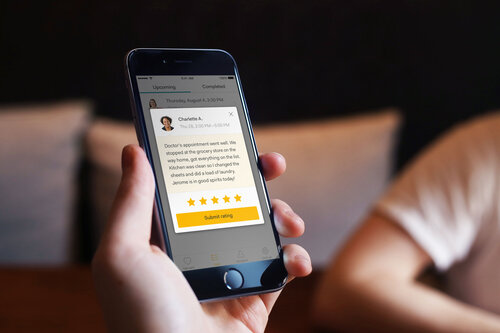

There are a wide range of payers and providers who already apply machine learning to some of their toughest problems and a huge amount of structured and unstructured data that flows through the larger healthcare system. The Honor platform is constantly using data to come up with novel ways to improve the quality of care in the home in an iterative way. For example, Honor’s been able to use data to improve timeliness of caregivers attending their visits based on a number of market, caregiver, and client-specific factors. Those insights help power our team’s operational processes; Honor Care Pros’ punctuality is above the industry average. As expected, timeliness can affect the client’s experience. Honor also empowers its caregivers to describe a client’s day in helpful narratives in the Honor Care Pro App. These notes allow families to look at trends on how often their loved one is going for a walk, what kinds of food they are eating, and how they are feeling – those are potentially interesting wellness indicators to them. Historically, health systems who have integrated home care into their continuum have been able to prevent readmissions, ED utilization, hospitalizations from falls, etc. Existing home care organizations today may have less exposure to machine learning when compared to a payer and can be more skeptical on layering in tech. However, as long as they see the outcomes from a process and quality standpoint that speak to how they manage home care, most of them come to understand the value of predicting a micro-behavior or a macro-trend among a large pool of caregivers.

The Pulse: With VC funding trickling into home care, how might increased investment fuel innovation?

Previously, it has been difficult for entrepreneurs to jump into a space that seemed capital-intensive and difficult to scale. I’m optimistic that VCs and entrepreneurs can start to strategically tackle this issue. The reality is that we have a fast-growing older population, particularly in developed economies, and we need a lot more innovation in the space. I think everyone wants to figure out how to enhance scalability in healthcare and adjacent industries such as home care, and technology helps create that scalability. At the same time, technology is only one factor in this equation because process and workforce innovation is hugely important if we want to work on quality, access, affordability, and transparency–all factors that are crucial to home care and further out in health care.

The Pulse: How do you see the home care industry evolving over the next decade?

With regulatory, partnership, and consolidation changes, we are going to see a lot of evolution in this industry. We will benefit from elevating the conversation around home care at the societal level, e.g., how are we going to care for older adults in the future when that demographic is growing and worsening the existing caregiver shortage?

In terms of regulatory changes, home care is not as regulated as home health or any other post-acute sector. In many states, home care isn’t regulated at all. There has been a trend towards increasing regulation–since the home care sector is growing so quickly in the US, there has been a reaction to push for more standards, especially in states that don’t require home care organizations to be licensed. States working on shaping this legislation are going to be successful because voters don’t want to hear about elder abuse or fraud–they want to address problems that stem from not having enough oversight. As the continuum becomes more integrated, we’ll see regulators trying to elevate standards across the whole industry.

Second, consolidation will definitely accelerate in this industry. A lot of the acceleration is being driven by an influx of capital from private equity players. There will be an interesting mix of employers who can leverage the power of technology and data to scale. However, there will also always be room for specialized home care organizations who want to serve a specific type of home care segment. Another mitigating force to this is the continued influx of new entrants. Smaller home health agencies are facing significant financial pressures due to reimbursement changes. Some home health industry consultants predict that thousands of these agencies will not make the transition to PDGM (Patient Driven Grouping Models) mandated in 2020. Some of these agency operators are already considering starting a home care company in their next career. These new entrants would definitely drive up fragmentation of the home care market in their geographies.

The final piece that is already starting to accelerate is ecosystem partnerships. Much of home care spend is currently out of pocket spend—but provider and payer stakeholders are starting to become more interested in social determinants data and preventing acute events. On the flip side when you look at retail, consumer or life sciences companies, they are trying to understand the older adult population to understand how to better segment and provide better services to get to the older adults that are most interesting to them. All of these players want to look at the micro behaviors in the home. Through enhanced platforms, they will get better and better answers to questions such as: What is the caregiver working on and what is the older adult experiencing on a day to day basis?

Interviewed by Monica Adibe, January 2020