Pushing the Frontiers in Price Transparency: A Conversation with Tara Bishop, Chief Clinical Strategy Officer at Bind

Conference 2020

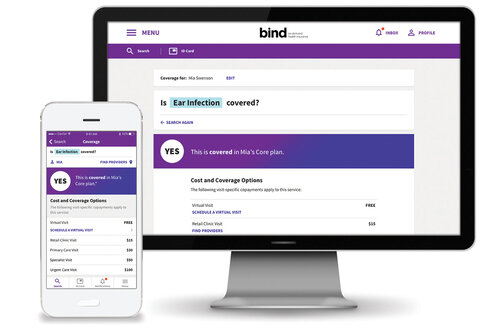

Many of us have shown up to the doctor for what we think is a simple visit, only to end up with several bills down the line. Bind, On Demand Health Insurance is working to help patients know the cost and value of their care before they walk in the door. Started in Minneapolis in 2016, Bind is a national health plan with members in all 50 states. The Pulse sat down with Chief Clinical Strategy Officer Tara Bishop to learn more.

Photo Credit: Bind

The Pulse: Can you please provide an overview of your background and how you got to Bind?

Tara Bishop: I started my career on a pretty traditional trajectory in clinical medicine—did the medical school thing and did my residency in internal medicine—all about 20 years ago. At that time things were different, but we were always facing similar problems: lack of care coordination, poor EHRs [electronic health records], overuse of ERs and readmissions, and more. I joined Cornell and worked as a primary care physician but also did a good body of work evaluating our health system and identifying critical issues like access to care for mental health, quality of care, medical errors and the rising cost of health care. At one point I realized I was publishing a lot of papers and identifying a lot of issues but wanted to be more involved in the solutions.

That’s when I had an opportunity to join McKinsey as a medical director in the Health Systems and Services practice. My projects there included developing value-based payment models. This felt meaningful because I was actually rolling up my sleeves with state Medicaid directors and creating programs to be implemented.

While there I was offered an opportunity at a startup called Bind, which is where I am now. Bind is a new health plan that helps people understand how much something will cost them before walking in the door of their doctor’s office.

The Pulse: Was it challenging making the transition from the provider side to the payor world?

TB: One of the interesting things looking back is that health systems were really embracing the changes that were happening across the board. Things like CMMI [Center for Medicare and Medicaid Innovation] were certainly impacting how health systems were behaving—all of a sudden we were measuring quality and trying to give information to prescribers on the cost of the medications. A lot of this change actually came from the payors, especially Medicare, and was impacting the bottom line for hospitals. I witnessed that change throughout my career. So, I actually found the transition from provider to consulting and advising payors to be quite natural because I had experienced a lot of the change we were seeing on the health system side and could share that experience with clients.

The Pulse: Tell us more about Bind and how the health plan works.

TB: Bind is a new health plan started in 2016 by a group of founders who are veterans in both health insurance and startups. The same group actually started a company in the late 1990s called Definity Health, which was one of the first consumer-driven health plans. Fast forward 20 years and consumer-driven plans are almost 40% of the market. When they started Bind, they felt the time was ripe for a whole new model of health plan design. The goal of Bind is to shift mindset in health care from doctors, hospitals and drugs to a new way of thinking. We start with the condition a person is dealing with or a health goal they want to achieve. We identify the options a person can consider for that condition or health goal and show how the Bind plan covers those options, including a clear, upfront treatment cost for each choice. Those costs are based on consumer value, so with Bind, members pay less when they choose treatments and health care providers that are more likely to help them effectively and affordably. All of this information is available to our members in the MyBind app or on MyBind.com, and we have a great Bind Help team to provide person-to-person support when a member wants it.

The Pulse: How exactly do you define value?

TB: Value is the relative quality or outcome you are going to get for the cost of your care, and it’s the critical ratio of the two that really matters. Certainly, there is price variation across the board, so that plays into the cost of care part of the equation. But there is also then relative value, or the idea that if you compare two physicians or two hospitals and price is equal, a higher-performing hospital with fewer readmissions or a physician with higher-quality ratings is delivering more value. We also consider relative value for a given person or condition. For example, for a knee arthroscopy, the procedure is going to have a different value for an athlete with a torn ACL than someone who has long-standing knee pain and arthritis and is just getting things cleaned up. There is a lot of evidence that the latter example doesn’t actually lead to better outcomes, whereas the person in the former example can experience good outcomes. That’s where a lot of the clinical thinking comes in, and where my role as chief clinical strategy officer ties in.

The Pulse: Can you elaborate on what a Chief Clinical Strategy Officer does?

TB: It’s not a traditional title. I like it because it’s a mix of utilizing clinical expertise and thinking about how we design our plan, which is the most novel thing about our company. How to define value is a tricky question and to do it at a personal level is even trickier. A clinical background is critical. I work cross-functionally to provide the clinical integrity and rigor we need for our plan design. A copay plan that ties price tags to very discrete services requires defining what things are in health care—what is a service, how are services related to each other, what is the relative value of one service to another. I think about various conditions, treatment pathways people will take to address those conditions, the relative value of those pathways and the pricing we actually have to tie onto that. I love my role because I get to work with actuaries, network operations teams and data scientists.

The Pulse: It sounds like you are almost designing new bundles. Is that an appropriate analogy?

TB: Yes. Most people think when they walk into a doctor’s office they will have a conversation, the doctor might do an EKG or swab their throat for strep, and then send them on their way. But then somewhere down the line they end up with two, three, four bills because that EKG was sent to a remote cardiologist who they didn’t know was going to read it. Most people think of that one visit to the doctor as a single encounter without realizing there are all these ancillary services happening around the visit. That’s one of the key things we are solving—trying to understand what the actual encounter someone is going in for is, what the expected services around that encounter are, what the bills associated with those services are, and how we can assign a copay for that entire encounter instead of for each individual service. So we do design things like mini-bundles around services, use data science to predict the costs, and then tie a copay to those things at a patient-friendly level.

The Pulse: Can you talk about how Bind is doing today, and how it has been able to scale?

TB: We are now a national company with Bind members in all 50 states. I am a Bind member in NYC, as is all my family. We have been able to expand through a strategic partnership with UnitedHealthcare [UHC], which enables us to offer Bind members the UHC national network. As part of that we now have data on every provider within the UHC network to feed into our pricing algorithms. We started out as a company in Minneapolis. Our first set of customers were in Minneapolis, but our market is actually self-insured employers. For them we serve as more of an administrative services organization.

The Pulse: Can you elaborate more on what distinguishes Bind from traditional health plans?

TB: We live in a day and age where you can know the cost of anything before you make a purchase decision—except health insurance or a health procedure. Even if you can look up the cost of a test, you still have to figure out your deductible, whether it’s in network, if there’s additional anesthesia, etc. This idea of enabling people to have a clear understanding of what things will cost them before they walk in the door—and that coverage begins immediately—are a few key features of Bind and what we think of as on-demand health insurance.

Another feature of Bind is the opportunity to flex your benefit anytime during the plan year. We have something called Add-Ins—a set of plannable, non-emergency procedures not covered under the plan during enrollment. For those plannable procedures, we let plan members purchase additional coverage anytime during the year. This enables us to lower the premiums people pay. It also gives patients an opportunity to pause and think about what kinds of treatments they want to have. That’s a pretty unique feature of Bind that differentiates Bind from other health plans.

The Pulse: Do you see a world in which Bind would be able to offer something like Add-Ins for chronic care?

TB: No. The Add-In model is really designed for infrequent, plannable coverage, not for chronic care. However, we do certainly think about how to maximize the value of care and help give price signals for chronic conditions. One example is lowering the cost of diabetic medications to try to improve adherence to them. Those are the kinds of things happening in the chronic disease space—actually lowering the cost barriers for things we know can lead to better outcomes.

The Pulse: Before I let you go, could you share some of the highlights of transitioning from the corporate world into the startup space in health care?

TB: I’ve had a wavy career, and some of the questions I ask myself when I consider a transition are: 1) Can I have impact? 2) Can I continue to learn and grow? and 3) Will I work with great people? In each of my transitions, I was able to answer “yes” to all three questions. That said, transitions are not always easy. I had never worked at a startup before and had never actually built things from scratch. The magnitude of work and the pace you have to work at is somewhat crazy at a startup, and all the stories people tell of pulling all-nighters and not showering are true. You have to build a lot very quickly and usually with limited resources. I have personally loved that type of approach, and one of the nice things is that you can get a lot done without going through tons of hoops.

From a challenges perspective, I think having to build things while driving the bus is hard. It’s especially hard to break into health care and health insurance. But we are excited to keep this going, to keep getting it into the hands of more and more consumers, and to help people and companies save money and enjoy better health.

Interviewed by Poorwa Godbole, November 2019